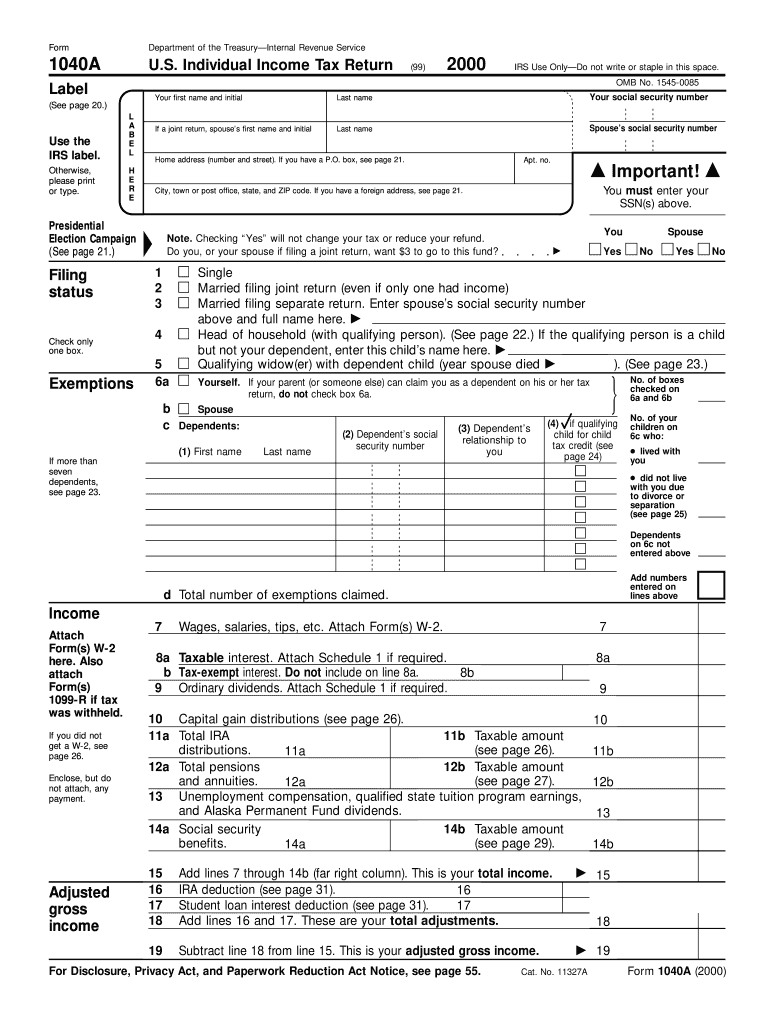

Do not include any social security benefits unless (a) you are married filing a separate return and you lived with your spouse at any time in 2014 or (b) one-half of your social security benefits plus your other gross income and any tax-exempt interest is more than $25,000 ($32,000 if married filing jointly). Gross income means all income you received in the form of money, goods, property, and services that is not exempt from tax, including any income from sources outside the United States or from the sale of your main home (even if you can exclude part or all of it). You should also file if you are eligible for any of the following credits.Earned income credit. Income Tax Return for Single and Joint FilersĮven if you do not otherwise have to file a return, you should file one to get a refund of any federal income tax withheld.

0 kommentar(er)

0 kommentar(er)